The mobile phone industry should be one of the world's largest and most productive industrial chains. At present, the mobile terminal market has undergone brutal competition, and the mobile phone brands are mainly left with only China, the United States and South Korea. And Chinese mobile phone brands are rapidly entering the high end. In fact, everyone can also feel that domestic mobile phones are not getting cheaper and cheaper. On the contrary, they are getting more and more expensive. While they are getting more and more expensive, sales volume and market share are still rising sharply. This is an industrial upgrade. fully reflect.

Let’s take a look at the situation of mobile phone supply chain enterprises. We often hear the saying that Chinese mobile phone brands only have the ability to integrate systems, that is, the life of an assembly plant. The core components are all in foreign countries. Is this the case? Unfortunately, as far as 2017 is concerned, it can be said that this statement is correct, but this situation is changing rapidly. China's mobile phone supply chain companies are growing at an unprecedented rate, and this phenomenon occurs because of Chinese mobile phone brands. The business has developed.

A mobile phone contains the proportion of domestic components. The domestic mobile phone brand is much higher than the US and Korean brands. I mentioned in the previous article that it is also a Japanese electronic component. Apple’s revenue is close to 13% for buying Japanese electronic components. Less than 5% of Huawei’s revenue is used to purchase Japanese electronic components. Therefore, the rise of domestic mobile phone brands not only means the decline of the share of foreign mobile phone brands, but also means that foreign electronic component companies are destined to decline.

Therefore, in the earnings reports of many Japanese electronic parts industry companies, the number of orders from China and South Korea increased during the quarter, in order to report good news. In fact, this is not a good thing, because the proportion of Chinese and Korean mobile phone brands purchasing Japanese parts, Both are far lower than Apple. The higher the share of Chinese and Korean mobile phone brands, the better the Japanese electronic components will benefit, but the reduction of Apple’s share will bring more losses to Japanese electronic components companies.

What hardware is the most valuable in the mobile phone?

According to the IHS disassemble report of Iphone in September 2016, the material cost of the 32GB version of the iPhone7 (A1778) is 224.8 US dollars (about 1499.4 yuan), and in April 2017, the Apple official website, 32G iPhone 7 The price is 5388 yuan, the material cost is 27.8%, that is, the amount other than the material is 3888 yuan, the ratio is 72.8%.

If we consider an OPPO R9S with a retail price of 2799 yuan, it can be reasonably inferred that the material cost of this phone is definitely not as high as Apple, which is less than 1,500 yuan, even if we are 1,200 yuan (of course I think it will actually be lower) Then, the amount of an OPPO R9S other than the material is 1599 yuan, the ratio is 57.12%.

It can be seen from this that the mobile phone brand brings a lot of benefits to a country. For a country, doing a mobile phone brand can bring more benefits than doing any electronic component, compared with a large number of high-tech in mobile phones. It is relatively easy to integrate discrete components and do mobile phone integration. Therefore, any country that does industrial upgrading, starting with downstream brands, can obtain a large amount of tax, employment and corporate profits, accumulate capital and brand market share, then support upstream component suppliers, and gradually expand to the upstream, is the most Good choice.

In fact, this is also the way China is now taking. In addition, we have seen that the local market in India has also begun to produce a large number of local mobile phone brands, and we know that the country of India is also beginning to make profits from the mobile phone industry.

Back to the iPhone7 teardown report, of course, the price of components is constantly changing, but we can still use the price as a good reference.

We sort from the most expensive to the cheapest:

The first is the display: $43;

The second is baseband, power amplifier and RF: $33.9;

The third is the processor: $26.9;

The fourth is the camera: $19.9;

The fifth place is the metal structure of the casing, etc.: $18.2;

Sixth electrical component (including touch motor, antenna, microphone, speaker, etc.): $16.7;

The seventh place is memory: $16.4;

The eighth is the User Interface (audio signal converter, audio amplifier, NFC, electronic compass, pressure sensor, etc.): $14

The ninth is the accessories for the box: $11.8;

The tenth place is the Bluetooth, GPS and WLAN modules: $8

The eleventh is the power management device: $7.2;

The twelfth place is labor and manufacturing costs: $5;

The thirteenth is the battery: $2.50,

The 14th place is Glue logic (small logic components): $1.3

If you look at the single most expensive device, nothing more than five items: display, processor, memory, camera, baseband + RF.

From so many components above, we can see that smart phones are actually a collection of the latest scientific and technological achievements of human beings, so it is a great thing to win in the fierce market competition. This is also 200 in the world. The country, in the end, only the enterprises of the three countries of China, the United States and South Korea occupy the top ten in the world.

Let's look at the most expensive component---the mobile phone screen. In the industrial products imported from China, the amount of display panel is in the third place for a long time, the first is semiconductor, and the second is automobile and parts. The third place is the reality panel.

2016 global smartphone panel trend: Hanzhong leads, Japan and Taiwan gradually decline

Looking at the global smartphone display in 2016, using the data released by CINNO Research in January 2017, global smartphone panel shipments reached 2.11 billion in 2016, an increase of 16.4% from 2015.

Interesting global smartphone production is only 1.47 billion units, but there are 2.1 billion screens. How many screens a person has to destroy in production, testing, transportation and use in a year... .

The world's smartphone panel suppliers are mainly concentrated in 15 companies in 4 countries (regions). Yes, there are 24 developed countries in the world. However, there are only 15 mobile phone screen manufacturers in the world, according to the economy. There are only four, so this is a high-tech industry that is uncompromising. As long as you enter this threshold, even if you are at the low end, it is also a member of the high-tech industry.

So there is no core technology in China, it is purely based on your definition.

These 15 companies, including 2 in South Korea, 7 in China (including Shenzhen Superconductor of Foxconn), 4 in Taiwan, and 2 in Japan (JDI, Sharp), in view of Sharp’s acquisition, they are rapidly implementing Japan under the leadership of Foxconn. Policy.

On December 30, 2016, Taiwan's Hon Hai Precision Industry and Sharp jointly established a TV LCD panel manufacturer, Display Products Corporation (SDP), officially announced that it will jointly build the world's largest new panel factory with the Guangzhou Municipal Government. It is planned to build a factory-centered industrial park. The two parties signed an investment agreement of about 61 billion yuan on the same day. The production line will soon move to Guangzhou. Sharp can also be regarded as a Chinese company.

There are always people in China who say that China's panel is at the low end. This sentence is correct, but please also note that the low end is also the fourth in the world. In developing countries around the world, only China can design and produce smartphone screens. Europe With so many developed countries in the United States, no country has a smartphone screen industry comparable to China.

In 2016, the market share of smartphone panels was 27.6% in Korea, 13.5% in Japan, 27% in Taiwan, and 32% in China. China is already the world's number one.

More important is the trend of change. According to the statistics of the panel suppliers, the shipments of panel suppliers in China in 2016 increased significantly by 44.5% year-on-year, mainly due to the increase in output of a-Si products and LTPS panels. In South Korea, shipments from South Korea's Samsung AMOLEDs increased significantly. Shipments in the region increased by 22.1% year-on-year, while those in Japan and Taiwan decreased by 12.3% and 0.6% respectively.

The once domineering Taiwan AUO has fallen out of the top ten in the world in 2016. Among the 200 new suppliers announced by Apple in 2017, Taiwan AUO has disappeared from Apple's supplier catalog.

LCD panels will gradually withdraw from the market in the future and have become the industry consensus. South Korea has taken the lead in the next-generation display technology AMOLED. Samsung has occupied 99% of the global market share of smartphone OLED screens, and the remaining less than 1%. Small batch shipments mainly from Chinese manufacturers, of course, while China's BOE, Tianma, and Huiguang are all investing heavily in AMOLED.

In the last one or two quarters, Samsung has been turning to AMOLED production, resulting in the global LCD panel out of stock, so the performance of major manufacturers have risen sharply, which also reflects that Samsung is currently in the industry with technology frontiers, pricing power and The initiative is the absolute hegemon.

We specifically look at the situation of these 15 companies in 2016:

The first place is Samsung. In the global small and medium-sized panel market, Samsung has an overwhelming market share. According to media reports, in the third quarter of 2016, Samsung's market share (in terms of sales) in the global small and medium-sized panel market reached 31.8%. According to CINNO Research's global quarterly mobile panel shipment monitoring statistics analysis report, in 2016, global AMOLED mobile phone panel shipments reached 370 million pieces, and domestic OPPO, vivo, Huawei, Jinli, Meizu, Lenovo and other manufacturers consumed them. 26%, and 99% of these AMOLED panels are from Samsung. It can be said that Samsung has taken an absolute leading position in AMOLED panel technology and market share.

The second place is China BOE Technology Group BOE, with shipments of 360 million pieces ranking second, up 16.1% year-on-year, with a market share of 17.1%. If you do not calculate the AMOLED panel market, BOE still has the market share of 17.8%, the largest panel supplier in the smart phone LCD market.

The third place is Korea LG Display, which ranks third with 210 million pieces and 150 million pieces with the second place, with a market share of 10.0%. Basically zero growth.

The fourth place is Japan's display JDI ranked fourth with 190 million pieces, with a market share of 9.0%. As domestic brands turned to AMOLED panels in 2016, and Apple's iPhone series sales were not as good as expected, resulting in JDI's sales of smart machine panels in 2016. Reduced by 5.0%.

The fifth CPT CPT, Taiwan CPT (including Lingju) ranked fifth with 160 million pieces, with a market share of 7.5%. Shipments still grew by 12.1% year-on-year.

The sixth Shenzhen Tianma Group TIanma ranked sixth with 150 million pieces and a market share of 7.3%. Benefiting from the full production and sales of LTPS products, Tianma's 2016 LTPS mobile phone panel shipments were approximately 50 million units, up 50.2% year-on-year.

The seventh China Longteng Optoelectronics IVO shipped nearly 150 million pieces in seventh place with a market share of 7.0%. Benefiting from the shortage of a-Si products in 2016 and the strong demand in the iPhone repair market, Kunshan Longteng Optoelectronics has become the largest growth supplier of intelligent machine panels with more than 100 million shipments. In 2016, it achieved a year-on-year growth of 150.8%. For the first time in the top ten.

The eighth Taiwan Innolux Innolux ranked eighth with 120 million units and a market share of 5.7%. Due to the earthquake and capacity allocation in Taiwan in early 2016, Innolux shipments in 2016 were the same as in 2015.

The ninth Taiwan Hanyu Color Crystal HannStar ranked ninth with 110 million pieces, with a market share of 5.6%, a year-on-year increase of 4.5%. HannStar is the leading supplier of On-Cell products for smartphones, with almost full coverage from entry-level smartphones to HD resolution products.

The tenth China Sharp Sharp ranked 10th with nearly 95 million pieces, with a market share of 4.5%, down 24.0% year-on-year. Due to the management changes caused by management changes in 2016, Hon Hai is expected to return to normal after entering the management in 2017. Please note that it is China's Sharp, Sharp Jun, please work hard to make a contribution to the party country's industrial upgrading in Guangzhou, the party state will not treat you badly.

The eleventh is Foxconn's Shenchao Optoelectronic Century ranked 11th with nearly 90 million pieces, with a market share of 4.2%. In 2016, it achieved a year-on-year growth of 196% by entering the market of Xiaomi and Huawei.

The twelfth place is AUO's AUO ranked 12th with 85 million pieces, with a market share of 4.0%, down 22.7% year-on-year. Taiwan’s AUO, which once had a strong push, has fallen sharply and fell out of the top ten.

The thirteenth is Wuhan Huaxing Optoelectronics achieved mass production in the third quarter of 2016, ranking 13th with 5.4 million shipments and a market share of 0.3%. Huaxing's first LTPS product will be launched into the mobile phone brand Meizu with FHD. At the same time, it also has the support of the group TCL brand. Its 2017 shipments can be seen at 50 million.

The 14th place is Shanghai Everlight (EDUdisplay), which is the largest supplier of AMOLED mobile phone screens in China. In 2016, it shipped 3.5 million pieces with a market share of 0.2%. Its AMOLED mobile phone screens are currently mainly FHD resolution, and have entered many domestic and international brands. However, in 2017, AMOLED mobile phone panel shipments saw 6 million pieces.

The fifteenth place is CEC-Panda, the only supplier of IGZO mobile phone panels in China. In 2016, it shipped 2 million pieces, ranking 15th and with a market share of 0.1%. In December 2016, CLP Panda signed a strategic cooperation agreement with Huaqin, a well-known mobile phone solution company, with a total amount of RMB 1 billion. It is expected to provide the most favorable technology and customer support for CLP Panda in the 2017 product sprint market. OLED will become the key to the next competition

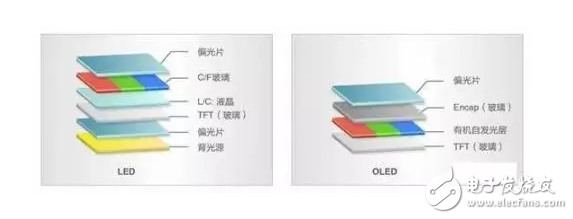

In the smart phone panel, it can be seen that Samsung, which ranks first in the world, has basically turned to AMOLED display production. In fact, LG also mass-produces OLEDs, but it is mainly used for large-size TV displays. China, Japan, and Taiwan are still dominated by LCD panels. In addition to Samsung, Huawei, Xiaomi, OPPO, VIVO, Gionee and other flagship machines, Apple's next-generation iPhone 8 will also adopt AMOLED technology. OLED mobile phone panels are the trend of the times. The current rapid expansion of OLED is the key to catching up with South Korea.

Domestic panel makers are also catching up. Domestic Shanghai Hehui Optoelectronics shipped 3.5 million AMOLEDs in 2016, less than 1% of Samsung's 370 million.

In 2016, BOE invested 100 billion yuan to build two 6-generation flexible AMOLED panel production lines in Chengdu and Mianyang. It is expected that it will be put into production in October this year, catching up with South Korea. If it can be put into production smoothly, it will be the second enterprise in the world to mass-produce OLED panels for mobile phones.

In 2016, Tianma also announced that it will optimize the TFT-LCD panel production line of the sixth-generation LTPS backplane being built in Wuhan as the AMOLED panel production line of the LTPS backplane. At the end of the same year, Tianma announced that a flexible development platform based on AMOLED technology has been completed.

In March of this year, Huaxing Optoelectronics and Wuhan Donghu New Technology Development Zone Administrative Committee officially signed a 6-generation LTPS-AMOLED project cooperation agreement, and plans to invest in the construction of a 6th generation LTPS-AMOLED flexible display panel production line with a monthly production capacity of 45,000 pieces. The product is a 3~12 inch high resolution small and medium size flexible AMOLED display panel. The project is scheduled to start construction before June 30, 2017, and mass production will be realized in 2020, with a total investment of about 35 billion yuan.

In contrast, JDI, the only display panel company in Japan, is a bit precarious. Apple's next-generation iPhone 8 has basically decided to adopt AMOLED technology. At present, Apple supplier JDI does not have the mass production capability of AMOLED panels, and JDI is currently losing money. Incapable of undertaking huge investment in production lines, Japan has lagged behind in the competition of display panels. Not only has the global market share of leading LCD panels declined by 5% in 2016, but also slow progress in the next-generation technology AMOLED field, unable to keep up with Korea and The rhythm of China.

JDI had previously requested new assistance from the Japanese government, the major shareholder, in order to prepare for the OLED fund. In addition, its own performance was not good and business pressure continued to increase. In order to get rid of the operational difficulties, the business policy can be recognized by the Japanese government. JDI will complete the 30% plan for layoffs from March 2016 to March 2017, and the number of JDI employees in Japan will be reduced from 5,702 to 5. 066 people (636 layoffs), the focus of this layoff will be the overseas employees, JDI will cut the number of overseas employees from 10020 to 5,920, and the number of layoffs will reach 4,100, of which Taiwan base and China base are the most important. The area of ​​layoffs.

As the main customer of Japan's JDI, Apple's iPhone 8 released in 2017 has already decided to use OLED technology, other customers Huawei, OPPO, and VIVO are also rapidly turning to OLEDs across the board. The prospect of JDI is very bad.

JDI has confirmed that it will merge with JOLED, the only OLED manufacturer in Japan this year. JOLED is a display company established by Panasonic and Sony. It focuses on OLED display panels. Together with JDI, it is the only two remaining in Japan, but JOLED has not been mass-produced.

The merger of JDI and JOLED is expected to be the fastest OLED panel to be mass-produced in 2018. This time is not only far behind South Korea, but also behind China for 1 year to 2 years.

At present, Apple has signed an exclusive OLED supply contract with Samsung. According to Apple's style, it is looking for an alternate supplier. Currently, the second manufacturer in the world that may mass-produce mobile phone OLED screens is BOE, which will be realized in October 2017. Production, Apple is currently in contact with BOE, once certified, it will be another major breakthrough after BOE has delivered the screen to Apple Macbook Air.

What is the progress of localization of panel raw materials?

While scrambling for time and South Korea's competition for OLED technology, LCD panels will gradually begin to decline, but there will still be demand in the next 10 years. Chinese companies are also rapidly working on the localization of core materials for LCD panels. Several raw materials, glass substrates, polarizers, filters, etc., are rapidly being localized.

In fact, many materials of liquid crystal panels and OLED panels have technical commonality. So mastering key raw materials is crucial.

The main six raw materials of the LCD panel: mixed liquid crystal materials, driver ICs, polarizers, backlight modules, glass substrates, color filters, let us take a look. First, the cost ratio of the six major raw materials in the following is for reference only. In this period, the cost ratio changes greatly.

1. Liquid crystal glass substrate

The liquid crystal glass substrate accounts for about 10% of the cost in the liquid crystal panel, and is one of the more expensive materials in the liquid crystal panel.

Corning, Japan's Asahi Glass and Electric Glass are the world's top three, occupying more than 90% of the world's market share, of which Corning's family accounts for 50% of the world. Therefore, we must say that the glass substrate is basically monopolized by the United States and Japan, but we must also note that the world's fourth largest LCD glass substrate manufacturer after the top three is China's Dongxu Optoelectronics Co., Ltd., in addition to Dongxu Optoelectronics, China There is another glass substrate production company Rainbow shares.

Although Dongxu Optoelectronics is the fourth in the world, it is very different from the top three. Even if Dongxu+Rainbow are added together, if the foreign-invested enterprises set up in China are removed, the domestic market share of domestic glass substrates is only 12%. %, accounting for less than 4% of the global share.

However, this situation is rapidly changing. In the first three quarters of 2016, Dongxu Optoelectronics Group achieved operating income of RMB 4.262 billion, an increase of 68.9% from the first three quarters of 2015, and a net profit of RMB 802 million, an increase of 8.39% year-on-year. The net profit margin is as high as 18.8%, which is close to the level of Apple. At the same time, Dongxu is most commendable. The equipment for producing glass substrates is basically developed by Dongxu. In fact, according to the financial report of Dongxu Optoelectronics, its first half of 2016 58 % of revenue comes from high-end production equipment and technical services for glass substrates.

Dongxu Optoelectronics' competitors, such as Japan's Asahi Glass Group, I have already introduced in the previous article about China Fuyao Glass Co., Ltd. 52% of Asahi Glass Group's business is glass, which is divided into two parts: automotive glass and flat glass.

Asahi Glass is not only losing ground in the automotive glass field and China Fuyao competition. In the field of liquid crystal glass, it was also challenged by Chinese companies. In the first three quarters of 2016, Asahi Glass's revenue from the glass business (including liquid crystal glass substrates and auto glass) decreased by 1.5%, and in the third quarter, it dropped by 5%.

Another domestic glass substrate company, Rainbow, has made good progress in 2016. In August, it successfully mass-produced China's first 8.5-generation glass substrate production line. Leading Dongxu Optoelectronics, 8.5-generation glass substrate is currently the largest demand for LCD panels worldwide. In part, Dongxu Optoelectronics' 8.5-generation glass substrate was also started in March 2016. This year, mass production will be carried out, which means that in 2017, China's two major glass substrate companies have successfully entered the 8.5-generation LCD panel market with the largest demand. It is expected that the global share of China's glass substrates will further increase and challenge the United States and Japan.

China ranks third in the world in the field of glass substrates, and is lagging behind the monopoly of the United States and Japan, but it is ahead of Europe and South Korea, and is rapidly increasing its share, indicating that China's industrial upgrading will not miss any field.

However, we must also see that the United States and Japan have already mass-produced the 10.5-generation glass substrate production line. China has just begun in the 8.5 generation, and the gap is still very large.

2, polarizer

Polarizers account for about 11% of the cost of liquid crystal panels, and are also the main materials. They are also one of the most difficult areas for the localization of LCD panel technology in China. Polarizers are located on both sides of the LCD panel, by transmitting or blocking the light emitted from the backlight module. Adjust the brightness of the pixel and reproduce the color so that the human eye can see the brightly displayed image. Without it, the LCD panel cannot be displayed.

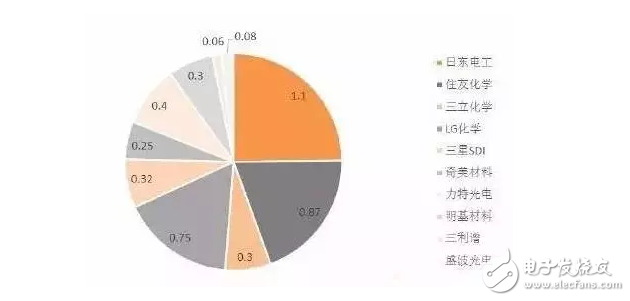

The global market currently has four players, global market share in 2015, Japan 51.2%, South Korea 24.1%, Taiwan 15.8, China 8.8%. China's production capacity is increasing very fast, because China's global share in 2012 was only 4.3%, reaching 8.8% in 2015 and doubled in three years. However, China's 8.8% global share is a bit awkward because it includes Taiwanese companies. The share of the joint venture company in the mainland.

If you only look at the global share of Chinese companies, that is, about 1-2%, it is simply a slag. If you only look at the Chinese market share, the local brand market share is only about 9%, mainly two: Shengbo Optoelectronics and Sanli Spectrum.

The above picture shows the production capacity of the world's major polarizer manufacturers in early 2016. It can be seen that the production of polarizers in the world is concentrated in the hands of eight companies in three regions of Japan, South Korea and Taiwan. The production capacity of these eight companies is above 30 million square meters. The ninth and tenth places outside the top eight are China's Sanli and Shengbo Optoelectronics, with a combined capacity of 16 million square meters.

The top three in the world are Japan Nitto Denko, Sumitomo Chemical of Japan and LG Chem of South Korea. Their production capacity is above 130 million square meters. However, due to the continuous decline in the world share of LCD panel manufacturers in Japan, Nitto Denko, which ranks first in the world, has begun to transform and no longer expand its production capacity. Another Sumitomo Chemical in Japan has also slowed down its expansion.

From the ratio of the top three to the world share, we can find that these three production capacity accounted for 80% of global production capacity in 2010, and this proportion dropped to 65% in 2013 and further decreased to 61% in 2015.

In addition to these three strong, the other five companies are between 30 million and 70 million square meters of production capacity, while the two companies in China, Sanlipu and Shengbo Optoelectronics (under the Shenzhen Textile) have not exceeded 10 million square meters. The two combined only 16 million square meters, and the market share is poor. According to the announcement issued by Shenzhen Textile on March 30, 2017, the actual output of the company's polarizer in 2016 was 8.667 million square meters.

However, as the absolute leader in the production of polarizers in China, Shenzhen Sanlipu Company, ranked ninth in the world, is growing very fast. In 2012, 2013 and 2014, Sanlipu Company's operating income was 243 million yuan and 411 million yuan respectively. And the net profit of 591 million yuan, respectively, was 78,795,900 yuan, 40,645,500 yuan and 6,969,700 yuan. In 2013 and 2014, the operating income and net profit increased by 69.32% and 43.79% respectively. And 127.06%, 71.52%.

In 2015 and 2016, Sanlixu did not publish earnings on the Internet. However, from various indications, Sanli Spectrum has maintained a super-high growth rate. At present, the biggest bottleneck restricting the development of Sanli Spectrum is the capacity problem, because with domestic LCD The global share of the panel continues to increase, and the demand for localization of polarizers is also rising.

At the beginning of 2016, Sanlipu's production capacity was only 7 million square meters. In November 2016, Sanlipu completed the first phase of the project in Hefei for the BOE, with a capacity of 16 million square meters, plus the original capacity of 7 million square meters in Shenzhen. It has already exceeded 23 million square meters, and has increased nearly four times in one year. It is close to the threshold of 30 million square meters of the world's top eight, but it is still very different from the threshold of the world's top three 130 million square meters.

However, Sanli has four lines under construction in Hefei (including polarizers for higher 10.5 generation LCD panels). It is expected to reach 86 million square meters in 2020, which is more than 10 times higher than 2016. In terms of production capacity, It will form the situation of Nitto Denko, Sumitomo Chemical, LG Chem, Samsung, and the top five in the world.

In addition to Sanlipu and Shengbo Optoelectronics, two domestic polarizing film manufacturers, Dongxu Optoelectronics Co., Ltd., a domestic glass substrate leader, also cross-border and Sumitomo Chemical joint venture (Dongxu Optoelectronics holds 51%) and invested 20 million square meters in Wuxi, Jiangsu. The polarizer production line is expected to be put into production in 2019 and will become the third TFT polarizer production enterprise in China. However, Dongxu production capacity will still only be at the end of the world's second-rate camp.

At this point, the good news is that by 2020, China's polarizer production capacity will be seven to eight times larger than that of 2015, and it will be largely localized and free from dependence on imports. The bad news is that even if it is seven times higher by then, the global market share of domestic brands is expected to be more than 10%. It is still unable to fully meet the needs of the domestic market and needs to be imported.

From the polarizer, it can be seen that BOE's pulling action on domestic polarizers, why the six lines of the leading company Sanli spectrum are all built in Hefei, because Hefei has BOE, domestic electronic brands drive the development of BOE, BOE pulls the development of domestic polarizers, this It is the road to industrial upgrading in China.

Looking further up, the two core raw materials of polarizers, PAC film and TAC film, account for about 75% of the cost of polarizer materials. Currently, they are still imported from Japan. Among them, TAC film is mainly supplied by Japanese manufacturers, Fuji Photo and Ke Nika Minolta's two Japanese companies have a global market share of 70% and 20%, respectively, which account for about 90% of the global TAC film market. Korean and Taiwanese manufacturers, including domestic Lekai, are also doing TAC film, but Shipments are small.

The Japanese company KUARARY (Kuraray) accounted for 65% of the global PVA film market. In addition, Japan is also in a monopoly position in the film of other raw materials for polarizers. For example, more than 90% of the AG film (anti-glare layer) market is occupied by Japanese electricians and Dainippon.

I believe that readers will feel very discouraged when they see this. It turns out that only TAC film can be produced by Lekai in the big sky, and all others rely on imports.

We must know the objective law of industrial upgrading. The localization of China's electronic brand products takes the lead in promoting the rapid development of domestic LCD panel enterprises. Now the rapid development of domestic LCD panel enterprises has driven China's polarizer companies to enter the world in 2020. In a camp, the share of China's polarizer companies is expanding, which will inevitably drive the demand for localization of upstream materials PVA and TAC films. The increase in localization rate is a matter of time.

This is not my guess. In November 2015, China Eastern Fluoroplastics Co., Ltd. invested in the construction of TAC film production line in Chengdu. It will be mass-produced in 2017 with a production capacity of 100 million square meters. It will become the first TAC film manufacturer in China. End the history of foreign 100% monopoly.

In addition to Dongfang Plastics Co., Ltd., in December 2015, China Xinlun Technology signed a cooperation agreement with Dongshan of Japan to obtain the relevant technology, quality use rights and import and export rights of the TAC film surface treatment; non-public offering of shares in 2016 Raise 1.8 billion yuan and enter the field of TAC production. Through the cooperation with Japanese companies, Xinlun Technology has crossed the technical barrier and is expected to become China's leading TAC film manufacturer.

On July 16, 2016, Xinlun Technology disclosed in the investor research interview record that the TAC film coating project invested about 1.5 billion yuan, and planned to construct 11 coating lines with a designed production capacity of about 90 million square meters per year. It is planned to be put into production at the end of 2017. The capacity release will be in 2018-2020.

However, the gap is still very large. For example, Japan Fuji, which accounts for 50% of the global TAC film, has a capacity of 820 million square meters.

China's domestic TAC film demand is expected to reach 360 million square meters by 2018. That is to say, even if the production capacity of Xinlun Technology and Dongfang Plastics is 100%, the total is only 190 million square meters, and at most it can achieve 50 in the Chinese market. % of import substitution.

Lekai shares, has not seen its LCD panel TAC film really shipped, but this situation will change, in August 2016, a total investment of 350 million yuan of China's Lekai Group Co., Ltd. liquid crystal display TAC film The third production line project of production line and solar cell back film was officially started in Baoding, Hebei Province. From the perspective of investment amount, the production capacity will still not be large.

In addition, PVA optical film, in fact, China has a very good PVA production enterprise, called Weiwei Gaoxin, in which the production and sales volume and market share of PVA exceed 30% of the domestic market; among them, the production and sales of high-strength and high-modulus PVA fiber It ranks first in the country, with a domestic market share of 80% and an international market share of around 45%.

However, note that the liquid crystal panel uses a PVA optical film. At present, only the Weiwei film has the PVA optical film production technology, and the mass production has not yet been achieved. The first phase of the 100,000-ton PVA optical film project has been completed in 2016. In April, it was approved by the China Securities Regulatory Commission, but the 100,000-tonne first-phase production capacity is very different from that of the competitor Kuraray. Japan Kuraray has a production capacity of 250,000 tons.

3, mixed liquid crystal material

The hybrid liquid crystal material is the basic material of the liquid crystal panel, which accounts for only about 3% of the total cost of the liquid crystal panel, but is critical to the performance of the liquid crystal panel.

China has one of the world's third-largest liquid crystal materials companies, Chengzhi Yonghua, with a domestic market share of 65%, but please note that LCDs include a variety of low-end black and white screens that can be liquid crystals, sincerely Yonghua is mainly Black and white LCD screens have an advantage.

The high-end TFT liquid crystal materials for smart phones and TVs, Germany's Merck, Japan's Chisso and Japan's DIC monopolize the TFT LCD market, with a global market share of more than 90%. It can be said that these three monopolize the global market.

China is mainly Chengzhi Yonghua and Jiangsu Hecheng can supply TFT hybrid LCD for LCD panel factory, and another 800 million LCD has also sprung up, becoming the first domestic LCD supplier in BOE 2017.

In 2016, the global demand for TFT liquid crystal materials is around 700 tons. The overall sales volume of mainland LCD material manufacturers is expected to be around 40 tons, accounting for 5.7% of the world's total. In 2015, mainland liquid crystal materials manufacturers shipped only 27 tons. That is to say, in 2016, China's domestic LCD material shipments grew by as much as 50%, far higher than the global development speed.

Compared with the global shipment of TFT liquid crystal materials, it was 600 tons in 2013 and 700 tons in 2016, with a growth of only 16% in three years. Domestic TFT liquid crystal material manufacturers are basically supplying to domestic LCD panel manufacturers. Therefore, in the next 10 years, domestic LCD materials will be expected to grow under the influence of domestic brands.

Taking Hecheng as an example, the operating income in 2016 was 385 million yuan, an increase of 73.76% over the same period of the previous year; the net profit attributable to the listed company shareholders was 79.833 million yuan, an increase of 91.41% over the same period of the previous year.

4, color filter

The color filter is one of the most expensive parts of the liquid crystal panel, and the cost accounts for more than 10%.

Most of the LCD panel manufacturers in the industry manufacture color filters. For example, Samsung's self-made ratio is 75%, while Chi Mei and LGD's self-made rate is as high as 90%. China's BOE and Tianma manufacturers also have their own color filter factory, but the proportion of self-made is less than that of South Korea and Taiwan, about 70% need to be imported, mainly imported from Japan's letterpress printing, Dainippon ink (DNP), East The three giants of TORAY.

The progress of localization of color filters is also gratifying. First of all, domestic major panel manufacturers are constantly increasing the proportion of self-produced color filters. At the same time that domestic LCD panel sales continue to increase, domestic color filters are purchased. The demand for films is decreasing, which is the result of the increasing proportion of self-made.

In addition, in the field of professional outsourcing, the domestic market is mainly led by Dongxu Optoelectronics, a leading company. In 2015, it invested heavily in RMB 3 billion to open a color filter production line. It introduced the technology and production line technology of DNP in Japan, DNP even The only fifth-generation TFT-LCD color filter production line will be transferred to Dongxu Optoelectronics, and its Chinese market share will also be transferred to Dongxu Optoelectronics. Dongxu Optoelectronics color filter customers have been fixed as domestic Longteng Optoelectronics and BOE, and mass production will begin in the first quarter of this year.

According to the "Strategic Cooperation Agreement" signed by Dongxu Optoelectronics and Longteng Optoelectronics, only one 5th generation TFT-LCD panel production line of Longteng Optoelectronics can digest more than 70% of Dongxu Optoelectronics' 5th generation color filter production line.

From the long-term investment of Dongxu Optoelectronics, we know that China's share of LCD panel field expansion, Dongxu's color filter products, into Japan, South Korea and Taiwan LCD panel supply chain is certainly difficult, into the domestic panel The supply chain is much easier.

However, we have to see that although the share is improving and the leading companies are investing heavily, we must also see that the domestic BOE and Tianma are still importing more than 70%, and Dongxu Optoelectronics started production in the first quarter of this year. The lines are also only the 5th generation line, and the color filters of the high generation are still blank.

5, drive IC

The cost accounts for about 5%. This is a relatively weak area in China. Currently, it drives ICs. Japanese mainly supplies apples, and Koreans produce and sell them. The panel driver ICs in mainland China are mainly from Taiwanese manufacturers.å’Œæ–°ç›¸å¾®ï¼Œæ ¹æ®CINNO Researchçš„æ•°æ®ï¼Œ2014年两家在ä¸å›½å¸‚场的å 有率为22.2%,其ä¸æ–°ç›¸å¾®å¤§çº¦14%ï¼Œæ ¼ç§‘å¾®å¤§çº¦8%。也就是75% 驱动IC需è¦è¿›å£ã€‚大多æ¥è‡ªå°æ¹¾ï¼Œä¾‹å¦‚è”å’,晨星ç‰ã€‚

å…¶ä¸å›½äº§æœ€å¤§çš„驱动IC厂家新相微,最近两年增速尚å¯ï¼Œ2016å¹´10月,京东方产业基金入股新相微,扶æŒå›½äº§IC增é‡ã€‚2017年,新相微将会首次é‡äº§LTPS-LCD的驱动IC,摆脱之å‰ä¸€ç›´ä¸èƒ½é‡äº§é«˜ç«¯LCD产å“驱动IC的情况。

æ®CINNOResearch预估,在国家集æˆç”µè·¯äº§ä¸šæ”¿ç–åŠèµ„金的扶æŒä¸‹ï¼Œé™¤äº†æ–°ç›¸å¾®å’Œæ ¼ç§‘微两家外,已ç»æœ‰æ›´å¤šçš„ä¼ä¸šå¼€å§‹å‘力é¢æ¿é©±åŠ¨IC市场,国内é¢æ¿é©±åŠ¨IC国产化率有望在2018å¹´æå‡è‡³35%以上,相比2014年增长60%ã€‚æ–°ç›¸å¾®çš„ç›®æ ‡ï¼Œæ˜¯åˆ°2020年进入世界å‰äº”。

6ã€èƒŒå…‰æ¨¡ç»„

背光模组是显示é¢æ¿æœ€è´µçš„部分,å 了æˆæœ¬å¤§çº¦20%以上,但是技术难度ä¸é«˜ï¼Œå±žäºŽåŠ³åŠ¨å¯†é›†åž‹äº§ä¸šï¼Œå…¨çƒç»å¤§éƒ¨åˆ†èƒŒå…‰æ¨¡ç»„都是在我国生产。

但是背光模组60%å·¦å³çš„æˆæœ¬æ¥è‡ªå…‰å¦è†œï¼Œä¸»è¦åŒ…括扩散膜,å射膜,增亮膜ç‰ï¼Œè¿™æ–¹é¢å›½äº§è¿›åº¦è¿˜ä¸é”™ï¼Œå‘展速度很快,

以光å¦å射膜为例å,å®æ³¢é•¿é˜³ç§‘技展现了æžé«˜çš„增长速度,2014å¹´è¥æ”¶1.49亿,2015å¹´è¥æ”¶2.5亿,2016å¹´è¥æ”¶å·²ç»è¾¾åˆ°4亿人民å¸ã€‚在液晶电视ç‰ä½¿ç”¨çš„大尺寸å射膜领域世界份é¢è¾¾åˆ°äº†35%,已ç»ä½åˆ—世界第一,超过了日本东丽和å¸äººã€‚

国内比较专注扩散膜,å射膜,增亮膜生产的å®æ³¢æ¿€æ™ºç§‘技,增长也很快,从2014年到2016å¹´ä¿æŒå¹´å¢ž30%的速度,份é¢åœ¨æŒç»æ‰©å¤§ï¼Œæ ¹æ®æ¿€æ™ºç§‘技2017å¹´2月å‘布的财报,2016å¹´è¥ä¸šæ”¶å…¥6.13亿元,增长29.79%,净利润6349万元,增长10.75%。

å…‰å¦è†œå›½äº§åº·å¾—新是龙头主力,已ç»æ˜¯ä¸–界最大的光å¦è†œç”Ÿäº§ä¼ä¸šä¹‹ä¸€ï¼Œæ ¹æ®2017年康得新å‘布的财报,全年收入92.25亿人民å¸ï¼Œå¢žé•¿22%,净利润19.78亿人民å¸ï¼Œå¢žé•¿37.47%。康得新是多业务集团,æ¥è‡ªå…‰å¦è†œçš„收入å 比大约70%å·¦å³ã€‚

然而更上游的æ料,国产还需è¦ç»§ç»åŠªåŠ›è¿™äº›å…‰å¦è†œçš„生产主è¦åŽŸæ–™æ˜¯å…‰å¦åŸºè†œï¼Œè¦ç”Ÿäº§å…‰å¦è†œï¼Œå°±è¦é‡‡è´å…‰å¦åŸºè†œï¼Œç›®å‰åœ¨å…‰å¦åŸºè†œæ–¹é¢ï¼Œå…¨çƒ80%以上的产能由三è±æ ‘è„‚ã€ä¸œä¸½ã€å¸äººã€æœé‚¦ã€å¯éš†ã€SKCã€ä¸œæ´‹çººç‰å‡ 大巨头所垄æ–。国产的厂家有ä¹å‡¯é›†å›¢ï¼Œåº·å¾—新,裕兴股份,å—洋科技(东æ—æˆåŒ–å¦ï¼‰ç‰ç‰ã€‚

康得新在光å¦è†œé¢†åŸŸè¿…速增长以åŽï¼Œä¹Ÿåœ¨å¼€å§‹è‡ªç ”å…‰å¦åŸºè†œï¼Œåº·å¾—新在2016å¹´4月开工建设光å¦è†œç¬¬äºŒæœŸ1亿平米高分åæ料工厂,就包括了光å¦åŸºè†œé¡¹ç›®ï¼Œé¢„计未æ¥ä¼šä¿æŒé«˜é€Ÿå¢žé•¿ã€‚

å…‰å¦åŸºè†œæ˜¯éœ€è¦PET薄膜(èšé…¯è–„膜)切片作为基æ,而Display Research估计2016å¹´å…¨çƒéœ€æ±‚为36万å¨ï¼Œç›®å‰æ£åœ¨é«˜é€Ÿå¢žé•¿çš„康得新有大约5万å¨äº§èƒ½ï¼Œé…套自己的光å¦è†œç”Ÿäº§ã€‚

å¦å¤–å—洋科技公å¸å‘布的2016年财报,公å¸å®žçŽ°è¥ä¸šæ”¶å…¥12.35亿元,åŒæ¯”增长33.73%;归属于上市公å¸è‚¡ä¸œçš„净利润1.20亿元,åŒæ¯”增长20.3%。 å—洋科技公å¸è¡¨ç¤ºï¼Œè¥ä¸šæ”¶å…¥å¢žé•¿33.73%的主è¦åŽŸå› 是公å¸â€œå¹´äº§2万å¨å…‰å¦çº§èšé…¯è–„膜项目â€çš„投产。

7ã€é¶æ

é¶ææ¤å‰ä¹Ÿä¸€ç›´æ˜¯æ—¥æœ¬éŸ©å›½åž„æ–,但目å‰å›½äº§åŒ–率也已ç»è¾ƒé«˜ï¼Œè€Œä¸”在进一æ¥æå‡ã€‚

隆åŽé›†å›¢æ——下是四丰电å是ä¸å›½é’¼é¶æ的主è¦ä¾›åº”商,å¯ä»¥ä¸ºå…¨ä¸–代的é¢æ¿äº§çº¿æ供产å“。四丰电å在2017å¹´3月çªç ´äº†LCDå’ŒAMOLED用高纯度宽幅钼é¶æ,宽度高达1800mm,是目å‰å…¨çƒAMOLED产线è¦æ±‚è§„æ ¼æœ€å¤§çš„é’¼é¶äº§å“,也代表钼é¶ç”Ÿäº§çš„最高水平。

å¦å¤–在ITOé¶ææ–¹é¢ï¼Œå›½å†…广西的晶è”光电公å¸åœ¨2015å¹´çªç ´äº†æ—¥æœ¬éŸ©å›½æŽŒæ¡çš„ITOé¶æç”Ÿäº§æ ¸å¿ƒç”Ÿäº§å·¥è‰º-----常压烧结ITOé¶ææŠ€æœ¯å·¥è‰ºï¼Œä»Žæ ¹æœ¬ä¸Šè§£å†³äº†å¤§å°ºå¯¸ITOé¶æ生产技术的å¯é 性和稳定性问题。该公å¸2016å¹´8月被国内龙头钼é¶æä¼ä¸šéš†åŽé›†å›¢æ”¶è´ã€‚

2017å¹´2月,隆åŽé›†å›¢æ——下晶è”光电已ç»åœ¨æ´›é˜³å¼€å§‹æ‰©äº§ï¼Œæœªæ¥ä¸‰å¹´å½¢æˆ200-300å¨ITOé¶æç”Ÿäº§èƒ½åŠ›ï¼Œæ‰“ç ´æ—¥éŸ©åž„æ–。2016年,å—主è¥çš„化工,石油,煤化工行业去产能影å“,隆åŽé›†å›¢ä¸šç»©å¤§å¹…下滑,但是其é¶æ业务å´æŒç»å‘力,æˆä¸ºå…¶ä¸€å¤§äº®ç‚¹ï¼Œä¸ŠåŠå¹´é¶æè¥æ”¶åŒæ¯”增长78.02%ã€æ¯›åˆ©çŽ‡åŒæ¯”增长12.40%

8ã€ç”Ÿäº§è®¾å¤‡

最åŽåœ¨ç”Ÿäº§è®¾å¤‡æ–¹é¢ï¼Œå›½äº§æ¶²æ™¶é¢æ¿åŽ‚å®¶æŠ•èµ„äº§çº¿ï¼ŒåŠ¨è¾„æ•°ç™¾äº¿ï¼Œåœ¨ä»¥å¾€å‡ ä¹Žéƒ½è¦ä»Žæ—¥éŸ©è¿›å£ï¼Œå›½å†…å„大é¢æ¿åŽ‚家也在努力实现生产设备的国产化。

例如åˆè‚¥æ¬£å¥•åŽæ™ºèƒ½åˆ¶é€ å…¬å¸ï¼Œä¸ºäº¬ä¸œæ–¹åšæ¶²æ™¶é¢æ¿ç”Ÿäº§è®¾å¤‡é…套,主è¦åšæ¬è¿æœºå™¨äººå’Œè‡ªåŠ¨æ£€æµ‹è®¾å¤‡ï¼Œè¯¥å…¬å¸2013å¹´æˆç«‹ï¼Œ2014å¹´è¥æ”¶å°±è¾¾åˆ°äººæ°‘å¸9,991万元,2015年更猛增5å€è¾¾åˆ°5亿元人民å¸ï¼Œ2016年预计也会超高速增长。

å†æ¯”如国内åšæ¶²æ™¶é¢æ¿å’ŒOLEDé¢æ¿äº§çº¿æ£€æµ‹è®¾å¤‡çš„龙头ä¼ä¸šï¼Œæ·±åœ³ç²¾æµ‹ç”µåå…¬å¸2016年实现è¥ä¸šæ”¶å…¥5.24亿元,åŒæ¯”增长25.5%;净利润9868.42万元,åŒæ¯”增长28.58%

2016å¹´4月记者采访北京亦庄京东方生产线,有以下æ述:

“8.5代液晶生产线基本实现国产化

在京东方8.5代液晶生产线的场区一隅,相关工作人员告诉北é’报记者,北京的8.5代液晶生产线,投建于2009å¹´8月,是当时ä¸å›½å¤§é™†é¦–æ¡8.5代线,也是目å‰ä¸ºæ¢è¡Œä¸šå†…投入é‡äº§è¿è¥çš„最高水平生产线。“2009年投建之åˆï¼Œç”Ÿäº§çº¿çš„ç›¸å…³è®¾å¤‡å‡ ä¹Žå…¨éƒ¨æ¥è‡ªäºŽè¿›å£ã€‚而从2009年到2016年,ç»è¿‡å‡ 年的快速å‘展,目å‰é™¤æ›å…‰æœºä»¥å¤–å‡ ä¹Žå…¨éƒ¨çš„è®¾å¤‡ä»¥åŠåŠ å·¥æ料,已基本实现国产化,对产业链æ¡å½¢æˆäº†å¼ºå¤§çš„带动性。â€

这个记者的æè¿°å…ˆä¸è®ºæ˜¯å¦ä¸¥è°¨ï¼Œè¯´æ˜Žè‡³å°‘在8.5代线上,国产化设备进展很大。除æ¤ä¹‹å¤–,东æ—光电和京东方ç¾ç½²äº†2014—2019年为期5年的战略åˆä½œå议,共åŒä¿ƒè¿›æ¶²æ™¶é¢æ¿ç”Ÿäº§è®¾å¤‡çš„国产化。

从ä¸å›½æ˜¾ç¤ºé¢æ¿äº§ä¸šçš„å‘展就å¯ä»¥çœ‹å‡ºï¼Œä¸å›½çš„产业å‡çº§ä¹‹è·¯æ˜¯ä»€ä¹ˆï¼Œæˆ‘国电åå“牌普éå·²ç»å‘展起æ¥äº†ï¼ŒåŽä¸ºã€OPPO〠VIVOã€æµ·å°”ã€æ ¼åŠ›ã€å°ç±³ã€ç¾Žçš„ç‰ç‰ï¼ŒåŸºæœ¬å‡€åˆ©æ¶¦éƒ½åœ¨10亿美元以上,åƒæµ·å°”ã€ç¾Žçš„ã€æ ¼åŠ›å‡€åˆ©æ¶¦å‡è¶…过20亿美元,海信集团净利润也超过10亿美元,åŽä¸ºæ›´æ˜¯è¶…过50亿美元。

国产电åå“牌崛起,必然会集体带动显示é¢æ¿çš„国产化,而显示é¢æ¿çš„国产化,åˆä¼šå¸¦åŠ¨ä¸Šæ¸¸çš„原æ料国产化,以å光片为例,有了京东方åšé 山,上游åšå光片的深圳三利谱集团æ‰æœ‰èƒ†é‡ç–¯ç‹‚投资产能,2016-2020年五年时间把产能扩大10å€ä»¥ä¸Šã€‚

ä¹Ÿå› ä¸ºå光片国产化率å¯ä»¥é¢„è§çš„æ高,æ‰ä¼šæœ‰æ–°çº¶ç§‘技,东氟塑料,皖维高新ç‰å›½å†…ä¼ä¸šç›¸ç»§åœ¨2015å¹´å’Œ2016年投资更上游的å光片ææ–™TAC膜和PVA膜æ料。

åŒæ ·ä¸ºä»€ä¹ˆä¸œæ—光电敢在2015年投资30亿人民å¸å»ºå½©è‰²æ»¤å…‰ç‰‡çš„线,åŒæ ·æ˜¯å› 为下游的国产é¢æ¿æœ‰å›½äº§åŒ–需求,æå‰é”定了订å•ã€‚

summary:

1ã€ä»Žä¸‹æ¸¸çš„电å终端å“牌åšèµ·ï¼Œé€æ¥å¸¦åŠ¨ä¸Šæ¸¸ï¼Œè¿™å°±æ˜¯ä¸å›½çš„产业å‡çº§ä¹‹è·¯ã€‚

我们也å¯ä»¥æ¸…æ¥šçš„çœ‹åˆ°ï¼Œä»Žä¸‹æ¸¸åˆ°ä¸Šæ¸¸çš„æ‰©å¼ æ€»æœ‰æ»žåŽæ€§ï¼Œæ‰€ä»¥æˆ‘们的市场份é¢ï¼Œä»Žä¸‹æ¸¸åˆ°ä¸Šæ¸¸çš„æ料呈现份é¢é€’å‡ï¼Œä¸Šæ¸¸æ料的世界市场份é¢æ˜Žæ˜¾ä½ŽäºŽä¸‹æ¸¸çš„å“牌,éšç€æ—¶é—´çš„推移,上游æ料的世界市场份é¢å¿…å°†é€æ¸å’Œä¸‹æ¸¸çš„份é¢çœ‹é½ã€‚

2ã€å“牌起æ¥äº†ï¼Œä¸Šæ¸¸é›¶éƒ¨ä»¶äº§ä¸šå¿…然会起æ¥

通过本文,大家å¯ä»¥ä¹Ÿå‘现了,在上游零部件,和更上游的æ料,生产设备,我们é‡åˆ°çš„竞争对手全部是日本,韩国,å°æ¹¾ã€‚

为什么æ°å¥½æ˜¯ä»–ä»¬ï¼Ÿä»–ä»¬æ— ä¸€ä¾‹å¤–ï¼Œéƒ½æ‹¥æœ‰æˆ–è€…æ›¾ç»æ‹¥æœ‰è¿‡å¼ºå¤§çš„消费电åå“ç‰Œï¼Œä»–ä»¬ä¹‹æ‰€ä»¥åœ¨ä¸Šæ¸¸è¿™äº›é¢†åŸŸå¼ºå¤§ï¼Œå°¤å…¶æ˜¯æ—¥æœ¬æœ€å¼ºå¤§ï¼Œè¿˜æ˜¯å› ä¸ºä»¥å‰æ—¥æœ¬ç”µåå“牌,å°æ¹¾ç”µåå“牌如日ä¸å¤©ï¼Œå¸¦åŠ¨äº†è¿™äº›äº§ä¸šçš„å‘展。

而相å,如今日本和å°æ¹¾ç”µåå“牌的衰è½ï¼Œå¿…然会拖累他们的上游产业份é¢é€æ¸ä¸‹æ»‘,è¦çŸ¥é“,ä¸å›½ç”µåå“牌,采用ä¸å›½äº§é›¶éƒ¨ä»¶çš„比例一定远高于日本å“牌,ä¸å›½å“牌越强,ä¸å›½ä¸Šæ¸¸é›¶éƒ¨ä»¶äº§ä¸šå…¬å¸å°±ä¼šè¶Šå¼ºã€‚

从这个æ„义上æ¥è¯´ï¼Œè‹¹æžœå…¬å¸å°±æ˜¯æ—¥æœ¬çš„救命稻è‰ï¼Œå¦‚果苹果在今年真的宣布,iphone 8除了三星以外的第二家OLED供应商是京东方,而ä¸æ˜¯JDI,那么日本显示行业å¯èƒ½çœŸçš„会完蛋。目å‰æ¥çœ‹ï¼ŒJDI背åŽçš„大股东日本产业é©æ–°æœºæž„决ç–éžå¸¸è¿Ÿç¼“,如果明年ä¸èƒ½é¡ºåˆ©å®žçŽ°OLEDé‡äº§ï¼ˆå³ä½¿è¿™æ ·ä¹Ÿæ™šäº†äº¬ä¸œæ–¹ä¸€å¹´ï¼‰ï¼Œé‚£ä¹ˆè‹¹æžœé€‰æ‹©äº¬ä¸œæ–¹çš„å¯èƒ½æ€§æ›´å¤§ã€‚

3ã€ä¸å›½çš„产业å‡çº§æ˜¯ä¸ç•™æ»è§’çš„å‡çº§

显示é¢æ¿ä¸Šæ¸¸çš„å‡ ä¹Žæ‰€æœ‰çš„é›¶éƒ¨ä»¶å’Œæ料,都有ä¸å›½å…¬å¸åœ¨å¤§ä¸¾æŠ•èµ„建厂,说明我们的产业å‡çº§æ˜¯å…¨é¢çš„,全方ä½çš„å‡çº§ã€‚ 而且上游å„大ä¼ä¸šï¼Œå‡åœ¨é«˜é€Ÿå¢žé•¿ã€‚

4ã€ä¸å›½æ˜¾ç¤ºé¢æ¿äº§ä¸šå‡çº§ï¼Œæ—¥æœ¬å°æ¹¾æ˜¯æœ€å¤§å—害者

通过本文,相比å„ä½ä¹Ÿå‘现了,日本å“牌在显示é¢æ¿ä¸Šæ¸¸çš„æ料和零部件领域最为强大,这å¥è¯ä¹Ÿå¯ä»¥è¿™ä¹ˆè¯´ï¼Œéšç€ä¸å›½æ˜¾ç¤ºé¢æ¿é›¶éƒ¨ä»¶å’Œæ料产业的兴起,å—å½±å“最大的也会是日本ä¼ä¸šã€‚韩国ä¸ä¼šå—åƒæ—¥æœ¬é‚£ä¹ˆå¤§çš„å½±å“ï¼Œå› ä¸ºä»–ä»¬æœ‰ä¸‰æ˜Ÿï¼ŒLGå¯ä»¥è‡ªäº§è‡ªé”€ã€‚

毕竟三星是世界出货é‡æœ€å¤§çš„手机和电视å“牌,ä¸ç®¡æ˜¯æ‰‹æœºè¿˜æ˜¯ç”µè§†ï¼Œéƒ½è¶…过全日本的出货é‡æ€»å’Œã€‚尤其是手机,三星一年出货3亿å°ï¼Œä¸–界第四的OPPOæ‰å‡ºè´§ä¸åˆ°ä¸€äº¿å°ï¼Œè€Œæ—¥æœ¬å“牌没有一家能进世界å‰å。

åŒæ ·æƒ…况的还有å°æ¹¾çš„é¢æ¿äº§ä¸šï¼Œè¿™ä¹Ÿæ˜¯è¿™ä¸¤å®¶æœ€ä¸ºå感我国产业å‡çº§çš„åŽŸå› ã€‚

Mineral Insulated Cable,Mineral Insulated Cable Accessories,Bare Copper Mineral Insulated Cable,Mineral Insulated Electrical Cable

Shenzhen Bendakang Cables Holding Co., Ltd , https://www.bdkcables.com