A few days ago, Boston Consulting issued the latest report on how asset management can complete changes with advanced intelligent technologies, and analyzed the contribution and implementation methods of artificial intelligence technologies such as machine learning and natural language processing in predictive reasoning of assets.

Asset management companies have been trying hard to make investment decisions for their clients with outstanding returns. To help customers manage assets, they have developed various strategies and models. However, in the traditional financial management industry, tools and analytical theories are similar. However, with the advent of digital technologies and the challenges posed to the tradition, the asset management industry is beginning to face changes. Digital technologies such as machine learning, artificial intelligence, and natural language processing have allowed many financial companies based on this type of technology, fintech companies for short, to create scene models more efficiently, with unprecedented precision and processing speed in investment analysis. Traditional investment analysis progresses and changes.

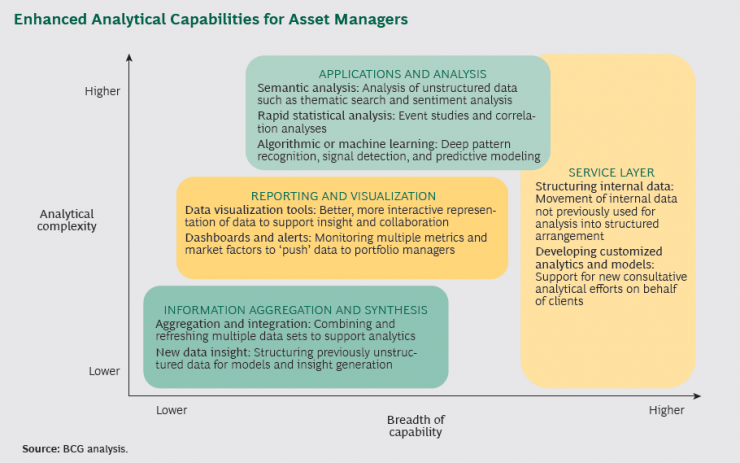

Examples of asset management innovations that are considered promising include machine learning platforms that can exploit a large amount of structured and unstructured data, artificial intelligence platforms that can make predictive inferences on important portfolios of securities, and research on large-scale events. Rapid analysis of correlation and analysis; Semantic analysis capable of identifying contexts and mining insights from different data types; Visualization tools capable of writing complex and diverse information in writing and visualizing them; Natural language processing engines and data aggregation platforms for convenience Managers get different forms of data in a timely manner.

Armed with these advanced technologies, digital asset management companies have significant information advantages over traditional investment consultants. They can get information through a large amount of data analysis, go deep into social media and other information media to understand investor sentiment... They can know in a timely manner how the weather changes will affect the portfolio, and they can even refute market beliefs with absolute objective results. , against the so-called authority.

In order to lag behind in this technological change, asset management companies should quickly adapt and use advanced digital technologies to enhance their sustainable development capabilities. Boston Consulting consulted this report and dismantled five key steps in the analysis of advanced technology investments:

Identify the right test opportunity

Gathers interdisciplinary stakeholders

Building a sandbox environment for testing and learning

Maintain a broad vision, find the right tools and partners

To align with the target operating model

Identify the right test opportunity

In the process of testing new technologies, companies should give priority to measures that can bring immediate benefits to a small group and constrain resources in a centralized manner. In this process, asset management companies should resist two temptations: the “mysterious and ignorant scientific experiments†that are narrowly focused, hinder the scale of results, and overly ambitious “Great Leap Forward†experiments, which are too expensive. The verification time is too long.

If the experimental project satisfies these three criteria, it is considered to have a greater success rate:

Ability to coordinate with the company's current investment process because it reduces the risk of "mechanism exclusion."

Can resolve obvious pain points, such as analysis that can help to require a lot of resources and time to collect and build data models.

Does not rely on large structures or new internal data capture.

A well-planned project is bound to clearly define a set of criteria, including more than one specific analytical problem, and the use of various tools. This combination of multiple functions ensures that the project progresses faster and with better results, that is, immediate adjustments based on real-world changes are made and optimization decisions are made; and the analysis of an event is more efficient.

Different companies have different timings for transformation, but the transition is not fast, but they are accurate.

Gathers interdisciplinary stakeholders

Those who understand finance in science and technology, and science and technology in finance.

Identifying favorable test opportunities in the business requires extensive expertise. If this task is left to the hands of an IT team or team of investment experts, it must be a failure. According to the report, the most successful companies, in addition to their financial support in the early days of their establishment, are also equipped with a diverse and interdisciplinary team of investment and technology disciplines.

In this process, managers can first select teams from investment experts in various asset classes and strategies, and then coordinate them with technology experts who have a data science background but lack investment strategy experience. Next, in order to contain each other, stakeholders can be added to the IT application development team. Well, the starting point of this small team's research is to use a revolutionary technology to maximize the optimization of the investment process.

Such a persuasive team naturally attracts funds, and then the cooperation model can also help the company to quickly get on track and start large-scale transactions.

Building a sandbox environment for testing and learning

The breadth of financial technology and other technological innovations has made the cost of trials lower than ever before, but such experiments require breathing space.

Many successful and innovative asset management companies have created a “sandbox†environment so that investment professionals have enough time, space, and data access to test different application cases. The technical team can also create an independent test environment. Ensuring the independence of the data environment allows team members to use and test the new model without being constrained by the company's architecture and risk assessment process.

Maintain a broad vision, find the right tools and partners

Asset management companies and technology suppliers increasingly see each other as potential partners. Many small financial technology companies have begun to customize analytical tools and programs for their asset management departments, and many investment companies have begun to embrace financial technology to quickly acquire digital technologies that can help them transform.

The report stated that in examining partnerships, it should be concerned about which areas depend on the company's goals. For example, Palantir and IBM Watson can help one another in quickly structuring data. One party gets important external data and one party can quickly develop analytics.

However, no matter how a company manages its partnerships, or the information or technical support it obtains, it should not be too early to imagine that their existing teams or skill sets can immediately make effective use of these tools and programs. Because of this, companies looking for partners should choose those who can grow with them.

To align with the target operating model

How can we grasp the best time to experiment and start large-scale promotion? The report stated that these three factors need to be considered:

Process and technology. Companies should determine what technologies they will use and how they will access and structure data from the perspective of business and IT architecture.

Run the structure. Companies need to consider how to build their organizational structure to make full use of support from partners, and to internalize the internal work of building and integrating those functional processes. This second point is especially important because companies will need specific analytical capabilities to use and maintain those investment tools, analyze the structure, and interpret the results.

organization. Companies must grasp the current capabilities of their asset management team members and the gaps in their skills. The support needed to assess these perceptions goes beyond the capabilities of data science, and it needs to identify individuals who can strategically think about the state of the industry and capture timely technology with promise.

Bnc Female To Female,Bnc Bulkhead Adapter,Bnc Female Chassis Adapter,Bnc Female To Female Adapter

Changzhou Kingsun New Energy Technology Co., Ltd. , https://www.aioconn.com