In the fourth quarter of 2012, the domestic PV module shipments soared to 11GW, a record high. The companies listed in the United States, including Yingli, Artes, and China Light Power, all will usher in the beautiful four-year report.

In the fourth quarter of 2012, the domestic PV module shipments soared to 11GW, a record high. The companies listed in the United States, including Yingli, Artes, and China Light Power, all will usher in the beautiful four-year report. On February 20th, Solarbuzz senior analyst Yin Rui said that the recovery of the European market, the growth of the market demand in the United States and Japan, the expansion of the domestic market, etc., are the reasons for the warming of the photovoltaic market. “At the same time, in the past year, many small and medium-sized photovoltaic companies Discontinue production or reduce production, so that the issue of overcapacity is partially resolved."

At the same time as shipments reached new heights, the issue of accounts receivable in the domestic market was again placed in front of photovoltaic companies. With the rapid growth of China's photovoltaic market, from the investors to the EPC vendors to the suppliers of components and auxiliary materials, the “triangular debt†issue of photovoltaic companies has not been able to sort out.

Zhongxing Optoelectronics Chairman Wang Xinghua frankly stated that although this year's domestic PV application market will have doubled growth compared to 2012, the company has been cautious all the time, “because we have always been more worried about the issue of domestic projects,†so the company Still based on the international market.

Warming domestic market conditions

“We are already looking at some used equipment, mainly new or how long it has not started production.â€

According to Solarbuzz, a solar professional research institute, China's PV installation capacity in 2012 was about 4.5 GW, an increase of 55.7% compared to 2.89 GW in 2011, making it the world’s second largest PV installation country after Germany.

In the view of Yan Rui, in addition to the new projects, together with 2012 projects that have not been started, the installed capacity of China's domestic PV market will reach new heights in 2013.

Many projects were not started in 2012 because many projects were approved in the fourth quarter of the year. At the same time, the price of components at the end of 2012 had fallen by nearly 50% compared to the beginning of the year. Considering that PV subsidy has not been adjusted downward, some companies will choose early 2013. Re-starting, thereby increasing the financial return rate of the project.

At the National Energy Work Conference on January 9, the National Energy Administration established the goal of installing 10 GW of photovoltaic power generation in China this year. The 10GW target doubles again compared to 4.5GW in 2012.

“We basically do not participate in bidding because it will be a price stabbing knife.†A Jinko energy sales person said that the company mainly establishes strategic alliances with the domestic five major power groups and local state-owned enterprises, which in turn drives sales of components. “In the past, sales in the domestic market were basically blank, but shipments in the domestic market had been shipped in hundreds of MW in 2012.â€

It is reported that. In January, Wuxi Suntech, Hareon Solar and other five key PV companies in Jiangsu sold 2.33 billion yuan domestically, an increase of 37% from the previous quarter, accounting for 76% of total sales in the month and an increase of 4 percentage points month-on-month.

Oriental Sunrise in its February 7 announcement said that the company has signed a solar module sales contract with China Energy Saving Solar Technology (Zhenjiang) Co., Ltd. with a total contract value of 408 million yuan.

A photovoltaic company executive in Jiangsu said that although there are claims to have more than 40 GW of component capacity in the country, it has closed more. "Seville's production capacity is almost 3 GW, and most of it is shut off; Suntech Power shuts down half. The component plants of Luan Huaneng (22.65, 0.47, 2.12%), Daxin Brand New Energy and other companies are no longer in operation. Many factories in Shaoxing and Yiwu Also stopped, thus making room for the big factory."

"I think China's current real production capacity of components is 20GW." The above executives forecast.

With 20GW of real production capacity, taking into account the fact that 70% of China's components are exported, if domestic installed capacity in 2013 reaches 10GW, the problem of overcapacity in domestic photovoltaics has been solved.

In fact, some large-scale first-tier plants are already brewing expansion plans. For example, JinkoSolar will expand 700MW on the basis of the current capacity of 1.2GW; Yingli has already started the expansion plans for Hainan and Tianjin bases.

"We are already looking at some used equipment, mainly new or not how long it will take to start production." A person in charge of Tianjin Yingli revealed to reporters.

Repayment problems

"The final payment period is too long, which will affect the PV company's cash flow and production."

In February, Chaori Sun, which was trapped in the quagmire, was brought to court by Hengdian Dongfang, but it was just a sign that the debt crisis in the photovoltaic industry began to spread.

“I am concerned that domestic PV companies will experience the financial risk of 'triangular debt' in 2013.†Wang Xinghua said that in the domestic photovoltaic power plant companies, the phenomenon of mutual arrears between upstream and downstream is extremely serious.

In the past year, LDK, Suntech Power and other companies have all experienced serious financial crisis, resulting in a large number of suppliers' dunning problems and eventually the introduction of state-owned capital.

Wang Xinghua said that although most of the domestic projects are conducted by state-owned enterprises, due to the restrictions on the central government’s funds at the policy level and the long process of approval within the state-owned enterprises, “the final payment period is too long, which in turn causes a cash flow to the PV companies and production. influences".

Zhongzhang Zhang, the manager of Zhongdian's photovoltaic market department, admitted to reporters that, compared to foreign countries, the domestic accounting standards provided a longer period of account, "usually about a year." At the same time, China does not have the habit of giving cash. Generally, the bill is given, but the bill needs to be cashed in three months or six months.

In fact, the current state-owned enterprises’ acquisition of power stations is also extremely demanding. In 2012, a power plant in Xinjiang was not connected to the grid on December 31st according to the agreement, and a central government company refused to acquire the power plant on the grounds of this, and the investment and birthplace for the construction of the power plant was in its hands.

“International trade has the protection of China Export Credit Insurance Corporation (hereinafter referred to as CITIC Insurance), so the issue of repayment is not significant.†Wang Xinghua said that the international trade rules are more stringent, and more importantly, “Simply speaking, the domestic market Integrity is not as good as international."

However, companies including Jinko Energy and Yingli have different attitudes toward the domestic market.

“The domestic market is actually a closed market. The players are relatively fixed. Most of them are 'Five Big Four' and local state-owned enterprises in power companies. We basically only do business with them.†The above Jinko Energy sales person said that the company is in the country. The account period did not exceed 30 days. "And domestic property rights are there. Customers do not pay. We will move the components back. Is it possible for foreign countries?" In addition, there are bad debt problems overseas. CITIC Insurance also lost a lot of money last year.

Take the Golmud region with the fastest power plant construction in the country as an example. In the newly-connected 583MW power plant in 2011, 63% of the 5 largest power generation groups were owned by companies, while private enterprises accounted for only 12.5%.

The aforementioned photovoltaic company executives stated that as a means of offsetting debt, the domestic photovoltaic companies applied the material-for-material exchange method to offset the risk of bad debts. “Like we do business with TBEA, we build a power plant with them, they buy our components, we use their inverters, and then offset on the accounts, do not need cash payments.â€

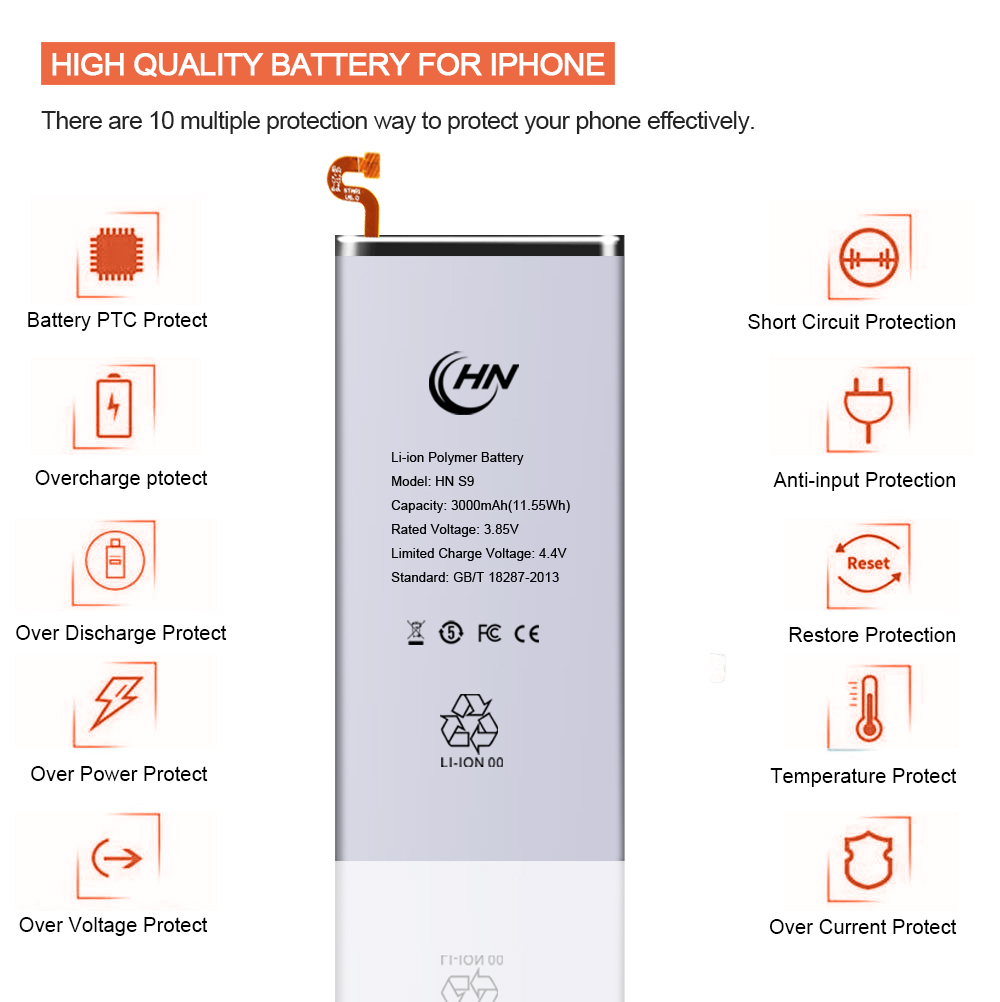

The Samsung S9 Battery is in full and real capacity,3000mAh.It has been under go very strict testing before sent out.The high standard s9 samusng battery will bring your cell phone a new life.All our batteries adopted with pure cobalt lithium polymer material,we only use famous brand battery core from listed company.Certified core with high quality IC make sure our goods in stable performance.It's safety and durable.

Samsung S9 Battery

Samsung S9 Battery,Battery For Samsung S9 Plus,Samsung Galaxy S9 Battery,Battery For Samsung Galaxy S9

Shenzhen Hequanqingnuo Electronic Technology Co., Ltd. , https://www.hqqnbattery.com