Japan has a long history of developing the LED industry. Since the development of a blue LED by Nakamura Shuzo, the LED industry has been thriving in Japan. In particular, the LED industry supply chain in Japan is complete. In addition to several major LED manufacturers, upstream and downstream materials also play a pivotal role in the global supply chain. Such as fluorescent powder, packaged silica gel, sapphire crystal rod industry. In the distribution of the LED industry, the settlement of LED manufacturers is mainly located in the Kansai area, and some material manufacturers are located in the Kanto area.

Japan's Miyagi earthquake affected the LED industry The impact of the Miyagi earthquake in Japan on the LED industry, according to LEDinside understand that the impact on the overall industry is not great. Some of the manufacturers located in the Kanto region are also safe and sound. However, due to the suspension of the operation of the Fukushima nuclear power plant and the disruption of traffic in some areas caused by the addition of the Shanghai Tsunami, the supply of certain components and materials was tight.

LED manufacturers Japan's leading LED makers, Nichia Chemical (Anan City, Tokushima), Toyota synthesis (Nagoya), are located in the Kansai area, so the earthquake has not caused too much for the two manufacturers. influences. As for Showa Denko, as the company is located in a part of the production line in Chiba Prefecture, under the tight power conditions, it will affect its output status. As for another large-scale packaging company, Citizen, because the company's production line is located in Fukushima Prefecture, the disaster situation still needs further understanding.

LED materials manufacturers sapphire substrate part, the main manufacturers Kyocera and Harmony, the two companies accounted for about 25% of the world's market share. However, the supply of Japanese sapphire substrate manufacturers is mainly used by LED manufacturers in Japan, but the proportion of foreign sales is not high. Although some of the production lines of Kumiki are located in Aomori Prefecture, it is understood from the side that the factory buildings have not been damaged. On the contrary, it is because of factors such as power cuts that affect output. The supply constraints, whether it will affect the Japanese LED manufacturers out of Japan to seek sapphire substrates is still worthy of attention. As for the gallium arsenide substrate used for providing quaternions, the main supplier was provided by Sumitomo Electric, and there was no case of tight supply.

MOSource (MOSource), Japan's MOSource supplier, is mainly provided by Sumitomo Chemical and Shin-Etsu Chemical. The two companies are all used by the Japanese domestic market and have not made any sales outside. It is estimated that they will not affect LED manufacturers in other regions. However, since the two companies have some production lines located in the Kanto region, the subsequent output situation is worth observing in the absence of electricity and inconvenient transportation.

The carrier wafer for MOCVD (Wafer Carrier) and the graphite carrier plate used with MOCVD machines are also important consumables. Due to the large-scale production expansion of MOCVD machines at this stage, the technical threshold of the MOCVD machine and the number of suppliers are limited. This makes the graphite carrier plate already in a state of tight supply. At present, the most important supplier in Japan is Toyo Tanso, and the factory is located in Kagawa Prefecture. However, due to its distance from the disaster area, it has not been affected much.

In Silicone Lens, global packaging silica gel is mainly supplied by Shin-Etsu Chemical and Dow Corning, while Shin-Etsu Chemical's factory in Japan is located in Gunma Prefecture. Currently, it has been inconvenienced by transportation and power shortage. Many packaging companies have indicated that the supply has become tight.

Phosphors, Japan's major suppliers of fluorescent powders include Nissan Chemicals and Mitsubishi Chemicals. Nissan has been providing yellow fluorescent powders (YAG), but in LED backlighting applications that emphasize high color rendering, Mitsubishi Chemical's red, green and fluorescent powders have a significant market share. Currently, Mitsubishi Chemical's factory in Odawara City has a certain distance from the disaster area. However, due to the traffic and electricity restrictions, some packaging companies also reflect a tight supply. influences. So looking at this point, Sapphire's global supply will only be temporarily affected by power failures.

After the earthquake in Taiwan, orders for the LED industry in Taiwan may increase. According to media reports, the Japanese earthquake has suffered much from LED damage, and it is in competition with Japanese factories. It is expected to benefit from transfer orders; if the key components of the panel are out of stock, Will become a problem with LED backlight shipments. Last week, the LED group first fell and then rose, with an average loss of 2.6%. However, the Japanese nuclear power plant crisis has stimulated energy conservation awareness and has long-term business opportunities. Some stocks have stopped falling and recovered. Jingdian and Huaxing have taken the lead and the weekly line has closed up.

Japan's LED industry is not affected by the disaster and is not directly affected by the earthquake, but may be limited by power restrictions and transportation, affecting shipments. Taiwan's LED industry and Japan are competing cooperative relations, Taiwan's Lei Jing Jingdian, Guanglei, Taigu Toyota, Syngenta, and Showa Denko were found to have the opportunity to benefit from increased OEM orders. In addition, the accident at the Fukushima nuclear power plant in Japan caused the world to face the danger of nuclear power generation and increase awareness of energy conservation and environmental protection. During the reconstruction process in Japan, procurement of energy-saving products such as LEDs will surely increase.

According to analysis, the accident caused by the accident at the Fukushima nuclear power plant is estimated to have a shortfall of about 20%. The new power generating unit will also need to spend one year at the earliest. It is expected that the “provincial†will be faster. This will also inspire the government’s energy saving products such as LED. demand. In addition, Guanglei is a foundry partner of Nissan, which accounts for about 15% of the revenue generated by orders from older generations. If according to previous plans, the proportion of OEMs will increase this year, it is estimated that it will account for more than 20%, and it is expected that there will be a post-earthquake generation in Japan. Work orders will increase more than expected.

Guanglei's revenue last year was 7.67 billion yuan, an annual increase of over 40%, and the first three quarters of earnings were 0.95 yuan per share, a 13-fold increase from the same period of last year. The legal person estimates that the earnings per share for last year was 1.2 yuan. In the first two months of this year, revenue of 1.253 billion yuan, an increase of 20%, is better than the annual growth of Epistar's revenue. Guanglei actively laid out its LED lighting market. It recently entered into a strategic alliance with the Shanghai Yaming Light Bulb Factory to cut into the LED lighting market in China. It is estimated that lighting revenue will grow significantly this year.

Taigu, who is also the OEM manufacturer for Japanese LED manufacturers, also received orders for the Showa Denko OEM. Taigu said that although the proportion of OEMs is not high at present, there is a chance of growth month by month. Showa Denko is headquartered in Tokyo and is affected by the earthquake. ? In addition, Taigu and Seoul Semiconductor have jointly established a round of technology and are responsible for LED sales. This will enable them to enter the European, American and Japanese lighting markets across patent barriers.

Taigu’s after-tax surplus last year was 360 million yuan, and its after-tax surplus was 1.5 yuan per share. The revenue for the first two months of this year reached 435 million yuan, an increase of 55%. Taigu said that the amount of orders received in March was higher than the revenue in February. In response to the dramatic growth in LED demand, Taegu increased its monthly production capacity from 60,000 units to 100,000 units in the first half of the year, and the expansion rate was about 60%.

Crystal Electric is Toyota's foundry OEM. It also has the opportunity to benefit from the transfer of orders when Japan's power supply is insufficient and the yen appreciates. However, this year, Jingdian does not need to transfer orders. The current production capacity is already full, and the amount of orders received in March is expected to grow by 20% compared with February. Jingdian had a record high performance last year, with a post-tax surplus of 5.766 billion yuan, an increase of 2.3 times year-on-year, and an after-tax surplus of 716 million yuan per share. It will issue a cash dividend of 4.5 yuan, much higher than corporate expectations.

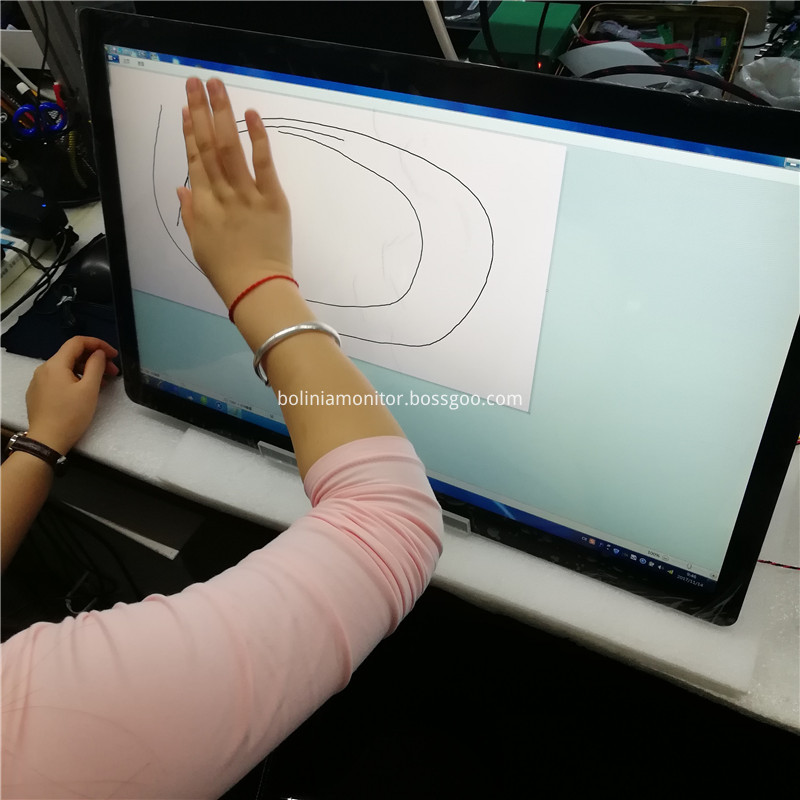

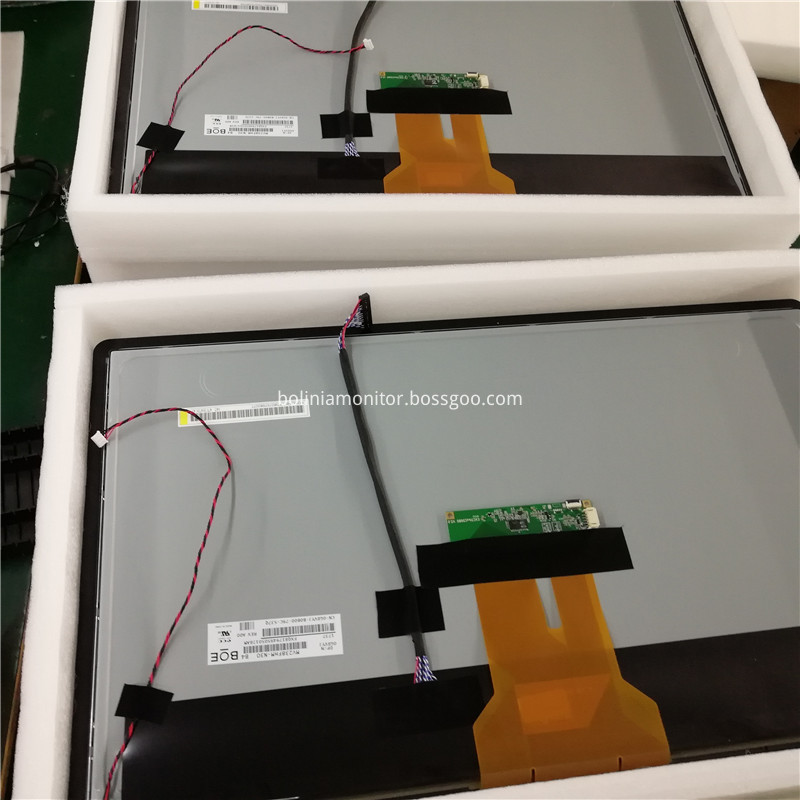

- One set of Touch Panel will be including:

- LCD screen, touch panel, main board controller, LVDS cable, press plate, button board, power adapter, VGA cable and USB line.

- Display: 23.8" TFT High Definition Capacitive Touch Monitor (16:9)

- Resolution: 1920*1080 pixels

- Brightness: : 250 cd/squa

- Contrast ratio: 1000:1

- Input voltages: 12V DC with power adapter 110 to 240V AC

- Response time: 6ms

- Viewing angle: 170°/160°

- Product size: 57.171*34.57*4.572 cm

- Screen material: tempered glass screen

- Touch panel: G+G

- Surface hardness: 7H

- Transparency: >90%±5%

- Operating temperature: 0 to 50°C/20%-80%(non-condensing)

- Humidity temperature: 0-85% at 40°C (non-condensing)

- Storage temperature: -20 to 60°C/5-95%(non-condensing)

- Storage humidity: 5%~95%

- Connection Type: USB

- Response time: <10ms

- Operation voltage: 3.3V-3.6V DC

Shenzhen Bolinia Technology Co., Ltd. is a manufacturer for 7-32 inch lcd monitors and displays over 13 years. Original factory with assembling line in Shenzhen. Product ranges from plastic monitor, Metal Monitor , resistive touch monitor, capacitive Touch Monitor , Open Frame Monitor , Embedded Monitor to SDI broadcasting monitor. Square monitor or wide screen monitors are available with different resolutions. Members in Alibaba, Global Sources and Made-in-China. Newly launched 10.1-32 inch All in One PC and portable LCD monitors.

Plastic or metal casing monitor from 7 inch

to 24 inch.

Single touch monitor with resistive 4 wire and 5 wire for options from 7 inch

to 22 inch.

Multi-touch projected capacitive touch ( PCAP Touch or PCT) monitor from 8 inch

to 24 inch.

SDI monitor from 15 inch to 21.5 inch.

High Brightness Monitor from 10 inch to 22 inch.

Mirror Image Monitor with

size: 8 inch, 9.2 inch, 10.4 inch, 12.1 inch, 15 inch, 17 inch, 19 inch, 20.1

inch and 22 inch.

All in One PC with Android system with 10.1 inch, 13.3

inch, 15 inch, 15.6 inch, 18.5 inch, 21.5 inch, 23.6 inch, 24 inch, 27 inch and

31.5 inch.

Portable LCD Monitor with 12.5 inch, 13.3 inch and 15.6 inch.

Products mainly used in ATM, POS, CCTV security, Information checking, Kiosk,

BGA repairing station, Lottery terminals, microscopes and similar applications. Portable LCD monitors perfectly compatible to PS4/PS3/PS2/Xbox ONE/Xbox 360, game consoles,

PCs, Macs, Raspberry Pi, laptops, cameras and tablets.

24 Inch Touch Panel

Touch Monitor,Touch Screen Monitor Price,Touch Lcd,24 Inch Touch Panel

Shenzhen Bolinia Technology Co., Ltd. , http://www.bolinia.com